Market Analysis Report of the Endoscopic Medical Device Industry (Rigid Endoscopes)

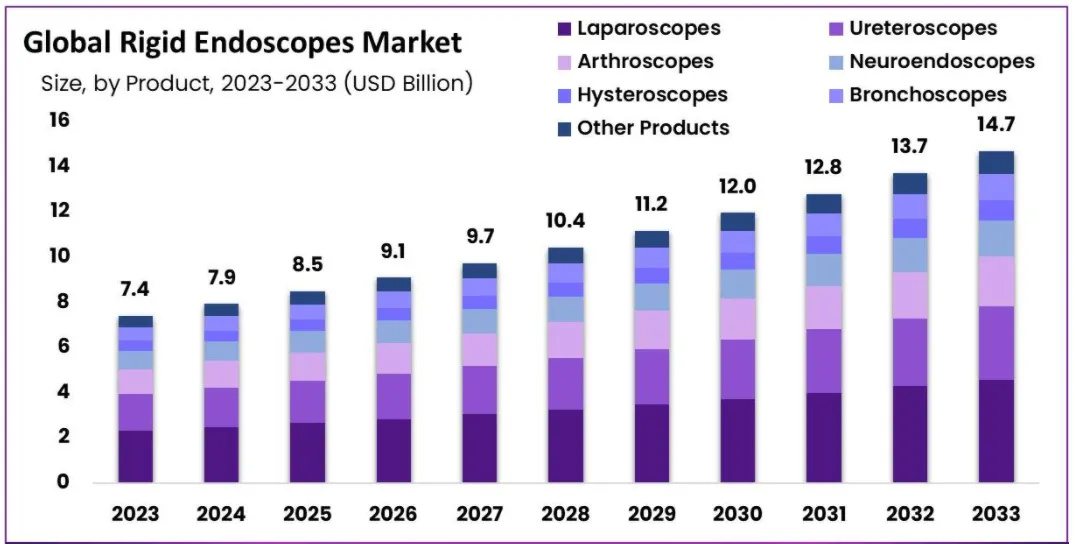

The market for rigid endoscopes is projected to reach approximately USD 7.4 billion by 2023, and from a baseline of USD 14.7 billion in 2023, it is expected to grow at a compound annual growth rate (CAGR) of 7.1% to reach USD 14.7 billion by 2033.

In recent years, the rigid endoscope market has experienced continuous growth, mainly due to the increasing demand for minimally invasive surgeries across various medical specialties. Rigid endoscopes are indispensable tools in modern surgical practice, enabling surgeons to perform complex procedures with greater precision while minimizing patient harm.

Key factors driving market expansion include technological innovations in rigid endoscope imaging systems, increased awareness among medical professionals about the advantages of minimally invasive surgery, and the rising incidence of chronic diseases requiring surgical intervention. Additionally, the ability of rigid endoscopes to reduce healthcare costs, shorten hospital stays, and accelerate patient recovery further promotes their application.

Key Points Summary:

- In 2023, the rigid endoscope market generated USD 7.4 billion in revenue, with a CAGR of 7.1%, and is expected to reach USD 14.7 billion by 2033.

- The product segment is divided into laparoscopes, ureteroscopes, arthroscopes, neuroendoscopes, hysteroscopes, bronchoscopes, laryngoscopes, otoscopes, rhinoscopes, and pharyngoscopes, among others. Among these, the laparoscope segment dominated the market in 2023 with a market share of 31.2%.

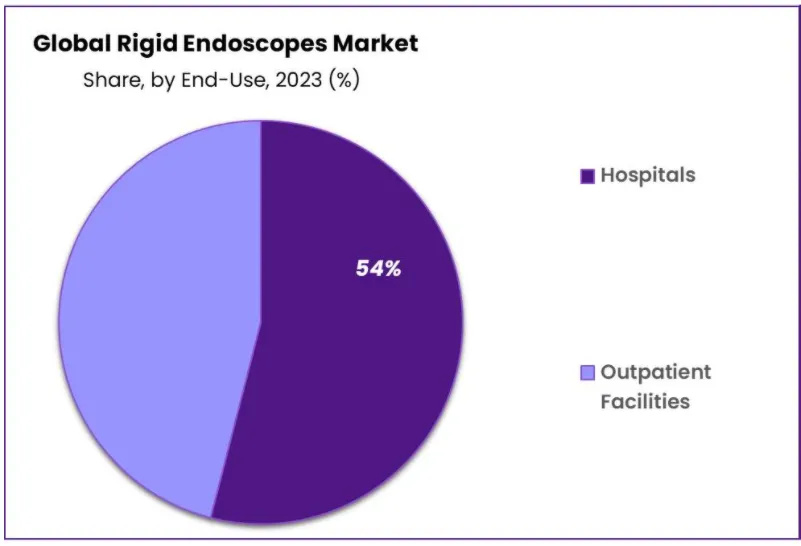

- In terms of end-users, the outpatient facilities segment emerged as the leader in the rigid endoscope market in 2023, holding the largest revenue share of 54%.

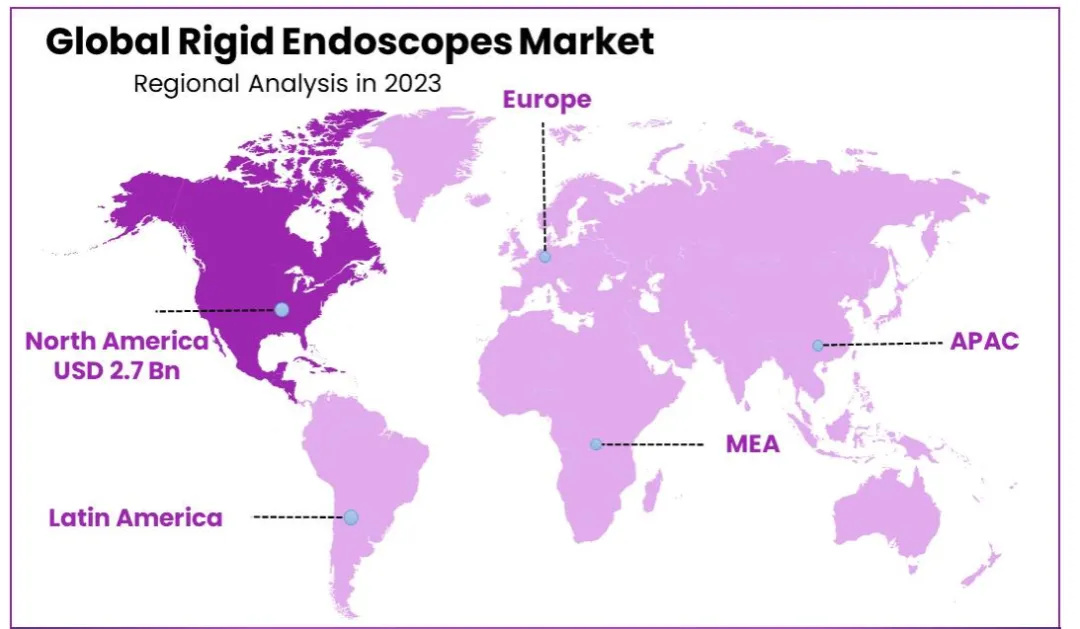

- North America led the rigid endoscope market in 2023, accounting for 37% of the market share.

Market Segmentation

By Product Analysis

Based on product classification, the market is segmented into laparoscopes, ureteroscopes, arthroscopes, neuroendoscopes, hysteroscopes, bronchoscopes, laryngoscopes, otoscopes, rhinoscopes, pharyngoscopes, and other products. Among these, laparoscopes held a significant market share, reaching 31.2%. Laparoscopic procedures, facilitated by laparoscopes, are widely accepted across various medical specialties due to their numerous advantages over traditional open surgeries. These procedures offer patients shorter recovery times, reduced postoperative pain, and minimized scarring, thereby improving patient outcomes and satisfaction.

Furthermore, laparoscopic surgeries typically result in shorter hospital stays, reducing healthcare costs and alleviating the burden on healthcare systems. The rising incidence of gastrointestinal, gynecological, and urological diseases further drives the demand for laparoscopic surgeries, consequently boosting the demand for laparoscopes. Technological advancements in laparoscopic imaging systems, such as high-definition cameras and advanced optical technologies, have enhanced visual effects and surgical precision, promoting broader adoption.

By End-User Analysis

From an end-user perspective, the market is segmented into hospitals and outpatient facilities. Among these categories, the outpatient facilities segment held the primary share of 54%. Outpatient facilities, including day surgery centers and clinics, are increasingly favored for their efficiency, cost-effectiveness, and patient-centered care approach. These facilities provide convenient and accessible venues for a range of surgeries, including those assisted by rigid endoscopes, outside the traditional hospital environment. Patients undergoing surgeries at outpatient facilities benefit from shorter waiting times, streamlined processes, and reduced risk of hospital-acquired infections.

Additionally, advancements in anesthesia techniques and perioperative care have expanded the scope of surgeries feasible in outpatient settings, including complex procedures previously confined to hospitals. The growing emphasis on value-based healthcare and healthcare reform initiatives further incentivize the shift towards outpatient facilities, as they deliver higher quality treatment outcomes at lower costs compared to traditional inpatient settings. These trends and innovations collectively drive the continued growth and evolution of the rigid endoscope market.

Market Factors

Driving Factors

- Rising Preference for Endoscopic Procedures: In recent years, both patients and healthcare professionals have increasingly preferred endoscopic procedures, driving the expansion of the rigid endoscope market. The multiple compelling advantages behind this shift include significantly reduced recovery times compared to traditional open surgeries. Patients undergoing endoscopic interventions typically experience shorter hospital stays and faster postoperative recovery, allowing them to return to their daily lives sooner.

- Minimized Scarring and Aesthetic Benefits: The small incisions associated with endoscopic procedures offer notable advantages, particularly in terms of aesthetics, as they preserve the natural appearance of the skin and reduce psychological stress for patients.

Restraining Factors

- Limited Reimbursement Policies: The growth of the advanced rigid endoscope systems market may be constrained by inadequate reimbursement policies for endoscopic procedures in certain regions. This challenge poses a significant barrier for healthcare providers considering investments in advanced endoscopic technologies. The reimbursement environment plays a crucial role in determining the financial feasibility of adopting new medical equipment and technologies, especially for budget-constrained hospitals and medical facilities.

Opportunities

- Expansion of Application Areas: The scope of the rigid endoscope market is experiencing significant expansion due to their increasing application across various medical specialties, beyond the traditional general surgery field. Orthopedics, urology, and gynecology are among the specialties notably adopting rigid endoscope technology, driving market growth. In orthopedics, rigid endoscopes are used for minimally invasive procedures such as arthroscopy, enabling surgeons to visualize and treat joint-related pathologies with enhanced precision and minimal tissue disruption.

- Urology and Gynecology Advances: Similarly, in urology, rigid endoscopes facilitate procedures like cystoscopy and ureteroscopy, allowing physicians to thoroughly examine and treat urinary tract diseases while minimizing patient discomfort and recovery time. Furthermore, rigid endoscopes have revolutionized gynecological surgeries by enabling minimally invasive interventions like laparoscopy and hysteroscopy, allowing for precise visualization and treatment of various gynecological conditions, from fibroids to endometriosis.

Impact of Macroeconomic/Geopolitical Factors

Economic Growth and Healthcare Expenditure

- Economic Growth: The rate of economic growth directly influences healthcare spending patterns, as robust economies typically allocate more resources to developing healthcare infrastructure, adopting technologies, and distributing medical procedures. Strong economic growth fosters investment in advanced medical equipment, including rigid endoscopes, as healthcare providers seek to enhance patient care and treatment outcomes. Conversely, economic downturns may lead to budget constraints and reduced healthcare spending, potentially slowing market growth.

Latest Trends

Integration of Digital Imaging Technology

- Digital Imaging: The integration of digital imaging technology into rigid endoscopes represents a transformative advancement, reshaping the landscape of minimally invasive surgical procedures. By incorporating high-definition cameras and advanced video systems, rigid endoscopes now offer unparalleled visualization capabilities, enhancing standards of care and driving adoption within the medical community.

- Enhanced Visualization: These cutting-edge imaging technologies provide superior clarity, resolution, and depth perception, enabling surgeons to visualize anatomical structures with extraordinary detail and accuracy during procedures. This enhanced visualization not only improves surgical precision and accuracy but also allows for better identification and management of pathologies, thereby enhancing patient safety and clinical outcomes.

Regional Analysis

North America Leads the Market

- North America: North America currently leads the global rigid endoscope market, accounting for 37.4% of the revenue share. This leadership is attributed to advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on technological innovation. The region boasts a mature healthcare system with a high adoption rate of rigid endoscope surgeries across various medical specialties. Additionally, the presence of major market players, robust research and development activities, and favorable reimbursement policies contribute to North America's dominant position in the rigid endoscope market.

Asia-Pacific to Achieve the Highest CAGR

- Asia-Pacific: The Asia-Pacific region is expected to achieve the highest CAGR during the forecast period. Several key factors drive this growth trajectory. Firstly, rapid economic development and increased disposable incomes in countries like China, India, and Japan are fueling growth in healthcare spending and infrastructure development. Consequently, the demand for advanced medical technologies, including rigid endoscopes, is rising to meet the growing healthcare needs of the population.

- Government Healthcare Policies: Government healthcare policies in the region are also driving growth by improving accessibility and quality of healthcare services, especially in rural and remote areas. Furthermore, the large population base in the Asia-Pacific region presents significant untapped market potential, particularly given the rising incidence of chronic and age-related diseases, further stimulating demand for rigid endoscopes and other minimally invasive surgical devices.

- Medical Tourism: Additionally, the increasing trend of medical tourism is contributing to the growth of the rigid endoscope market in the region, as patients seek high-quality medical services at cost-effective prices. With the rise of medical tourism, healthcare institutions in the Asia-Pacific region are upgrading their facilities to attract international patients, including adopting the latest rigid endoscope technologies.

Market Competition

Competitive Landscape

- Intense Competition: The competitive landscape of the rigid endoscope market is characterized by intense competition among existing players, driven by the surge in demand for endoscopic devices across the spectrum of therapeutic and diagnostic procedures. This competition is further intensified by the ongoing technological advancements in endoscopic instruments by major market players, deepening the competitive intensity in the market.

- Strategic Focus: Leading industry competitors are strategically focusing on securing regulatory approvals for their innovative products, launching new products, establishing strategic partnerships, and undertaking a series of other strategic initiatives to gain a competitive edge in the market. Specifically, these strategies may include:

- Product R&D and Innovation: Companies invest substantial resources in research and development to introduce new rigid endoscope products with enhanced image quality, smaller sizes, greater durability, and additional functionalities to meet evolving clinical needs.

- Mergers and Acquisitions: Industry players often engage in mergers and acquisitions to expand their market share, enter new geographical markets, and diversify their product portfolios. This allows them to capitalize on synergies and enhance their competitive position in the market.

- Collaborations and Partnerships: Collaborations with other companies, healthcare institutions, and research organizations enable the sharing of knowledge, technology, and resources to drive innovation and development in the rigid endoscope market. These strategic partnerships facilitate the advancement of endoscopic technology and the development of more efficient, accurate, and user-friendly devices.

- Market Expansion: Companies actively pursue opportunities to expand their presence in emerging markets, particularly in regions experiencing rapid economic growth and healthcare infrastructure development. Market expansion initiatives include establishing local manufacturing facilities, strengthening distribution networks, and engaging in targeted marketing efforts to increase brand recognition and market penetration.

Conclusion

In conclusion, the rigid endoscope market is poised for continued growth driven by technological advancements, the rising preference for minimally invasive surgeries, and the expansion of application areas across various medical specialties. The market's competitive landscape remains dynamic, with key players focusing on product innovation, strategic partnerships, and market expansion initiatives to maintain their competitive edge. As healthcare systems worldwide increasingly adopt rigid endoscope technologies, the market is expected to witness sustained growth, improving patient outcomes and enhancing the overall standard of care.